More than 10 years ago, Nobel Peace Prize Laureate Muhammad Yunus said “I firmly believe that we can create a poverty-free world if we collectively believe in it. In a poverty-free world, the only place you would be able to see poverty is in the poverty museums.” Unfortunately, poverty still exists.

Prize Laureate Muhammad Yunus said “I firmly believe that we can create a poverty-free world if we collectively believe in it. In a poverty-free world, the only place you would be able to see poverty is in the poverty museums.” Unfortunately, poverty still exists.

Part of the reason for the survival of poverty is that a large number of people remain unbanked. Globally, about 1.7 billion adults are financially excluded in 2017 compared to 2 billion in 2014. China has the world’s largest unbanked population, followed by India (190 million), Pakistan (100 million), and Indonesia (95 million). These four economies, together with three others — Nigeria, Mexico, and Bangladesh — are home to nearly half the world’s unbanked population.

These figures show that the way towards a world where everyone has access to financial services is still long. Microfinance sector’s stakeholders therefore have room for growth. Large private microfinance institutions and microfinance investment vehicles (MIVs) can be instrumental in the fight against these inequalities.

But in a market as profitable as microfinance1, can their actions really be trusted to be socially oriented? The microfinance sector was heavily delegitimised during the 2000s because of the crisis of over-indebtedness impacting poor people, casting doubts on the social aspect of microfinance. Is the current context better now? Did private stakeholders find the right balance between financial return and social performance?

Today’s investors generally care about their social impact

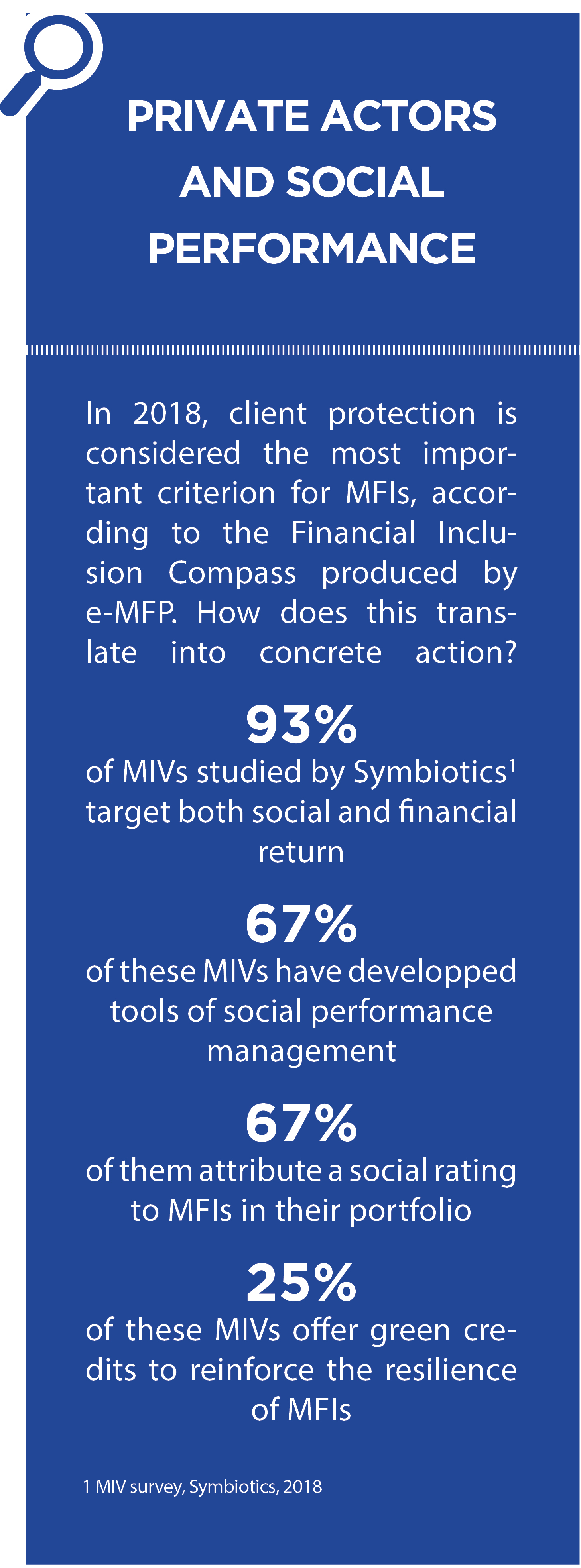

Efforts have been made over the last years for greater transparency and qualitative social assessment. Reports tend to show that this concern is now well understood by the sector. For instance, the 2018 Financial Inclusion Compass2 produced by the European Microfinance Platform (e-MFP) demonstrates that client protection is recognised by microfinance stakeholders as the most important criterion in achieving the objectives of financial inclusion whereas governance is ranked at the third position.

This concern is also true for investors. The 2018 MIV survey by Symbiotics3 shows that most microfinance investors and fund managers are taking various aspects of social performance into account4. Most of the surveyed funds (77 out of 83 respondents) mentioned that they target both financial and social returns. What could only be a statement turns into a stronger commitment when an assessment is performed.

And as a matter of fact, the majority of MIVs measured both financial and social returns (64 out of 83), while a minority (6 out of 83) focused exclusively on measuring financial returns.

The survey also shows that MIV’s measurements mainly come from collecting and analysing outreach indicators on their investees. Besides, 67% of them used in-house developed tools to assess their investees’ social performance management. Finally, 67% of MIVs conduct internal social ratings on the MFIs of their portfolios.

BNP Paribas, like other funds, also assesses the social performance of investees as part of its Corporate Social Responsibility. Pro bono social due diligence missions are offered to the MFI we are working with. During one week, a couple of high potential executives perform an SPI4 audit after they have been trained by the NGO Cerise. We benchmarked our microfinance portfolio with 286 other MFIs in the world assessed with the SPI4 methodology and the results are conclusive: the MFIs financed by BNP Paribas have a score significantly higher than the average. Indeed, the 26 MFIs audited (out of 34 MFIs financed) reach the score of 79/100, whereas the global score is 64/100 showing that a large investor can truly make an impact with their investments in microfinance.

The triple bottom line

Social performance is a key element of microfinance’s DNA. A large part of the main stakeholders knows it and cares about displaying it to show their effective commitment to achieving their social mission.

Yet, another challenge arises for the microfinance market. The issue of environmental performance (see also p.14-15) is gaining significant importance as 25% of MIVs’ investees are offering green loans specifically designed to finance the purchase of environmentally friendly products, such as solar panels, biodigesters, or clean cookstoves. BNP Paribas itself partnered with the UN environment and Yapu, a Berlin based start-up which develops a digital solution for sustainable agricuture to allow two MFIs in Senegal and Colombia to test a pilot for sustainable agriculture microloans.

Together with financial and social dimensions, environmental performance is on track to become a new standard for the microfinance sector. And that triple bottom line could just be the new opportunity for the sector to show its relevance and impact.

1 MFIs portfolio yield was assessed at 20.9% in 2016 according to the 2018 Microfinance Barometer

2 www.e-mfp.eu/sites/default/files/resources/2018/11/e-mfp_Financial%20Inclusion%20Compass_A4_def3-web.pdf an account, 56 percent of all unbanked adults globally (figure 2.2).

3 https://symbioticsgroup.com/wp-content/uploads/2018/10/Symbiotics-2018-MIV-Survey.pdf

4 According to Symbiotics, the average number of active borrowers financed by MIV was around 494 K by MIV for 91 MIVs.

ALAIN LEVY

HEAD OF MICROFINANCE

AND SOCIAL ENTREPRENEURSHIP

FOR ASIA AND AMERICAS

BNP PARIBAS![]()