At the occasion of the European Microfinance Week, organised by e-MFP, we re-publish the key figures of financial inclusion in Europe, first realesed in the 2017 Microfinance Barometer. This article was written by Nicola Benaglio, Policy and Research Officer at the European Microfiance Network (EMN).

In the context of economic crisis and growing inequality that Europe has faced in the last years, microfinance has emerged as an important policy tool to fight against social and financial exclusion, promote self-employment and support microenterprises.

Nonetheless, today in Europe there remains a significant, unmet demand for people and microenterprises who are financially excluded. The European Microfinance Network (EMN) and Microfinance Centre (MFC) Survey Report 2014-20151 provides evidence on how the microfinance sector can take on the challenge and fill this financing gap.

European MFIs are supporting an increasing number of financially excluded

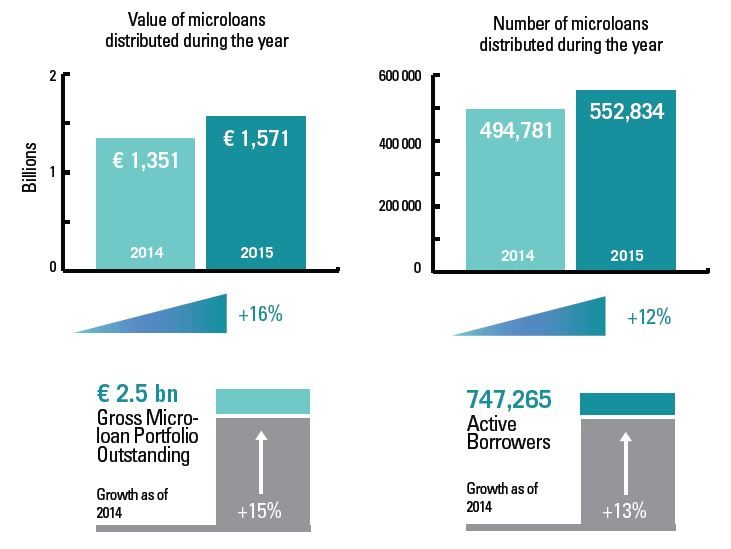

A ccording to the Report, which surveyed 149 MFIs from 22 countries2, the microfinance sector has been steadily growing over recent years. In 2015, the surveyed Microfinance Institutions (MFIs) disbursed a total of 552,834 microloans with a total volume of almost 1.6 billion euros. Overall in 2015, MFIs reported 747,265 total active borrowers, with a gross microloan portfolio outstanding of 2.5 billion euros. These indicators show a double-digit growth over the 2014-2015 period and reach a growth rate upwards of 50% when considering a 4-year time span (2012-2015).

Figure 1 : Trends in microlending activity and outreach

Business microloans as MFIs’ core activity (loans below 25.000 euros)

Business microloans support self-entrepreneurs and microenterprises who are financially excluded whereas personal microloans support the needs of vulnerable clients such as rent, education and personal emergencies, as well as employability investments (e.g. financing the purchase of a car).

From the MFIs perspective, the combination of business and personal products depends on the specific mission and business model, but could also be the result of the regulatory framework in place at the national level. For instance, in some countries, MFIs are only allowed to provide business microloans.

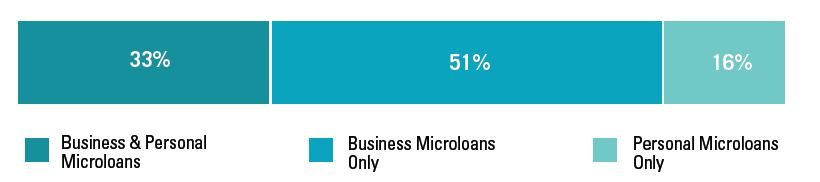

In Europe, the majority of the MFIs offer business microloans only, 1/3 provide a combination of business and personal microloans and a limited number of MFIs offer personal microloans exclusively.

Although personal microloans show remarkable growth in the recent period, the majority of the gross microloan portfolio (71%) is allocated for business microloans. This reflects the large share of MFIs that exclusively offer business products and the fact that European Union (EU) support (e.g. funding) has been traditionally focused on MFIs that finance income generating activities rather than the personal needs of clients. In addition, another important element is the significant average size difference between business and personal microloans.

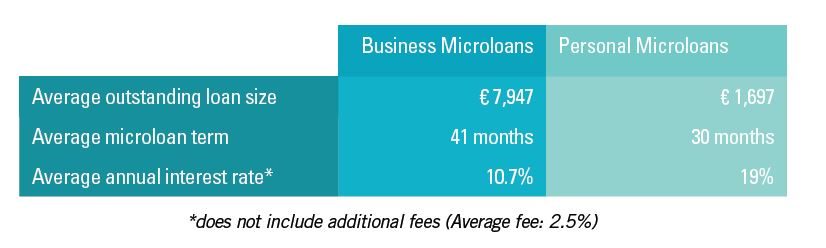

In fact, business and personal loan products, which are designed to meet different clients’ demands, differ greatly with regards to their terms and conditions. On average, personal microloans are much smaller in size, offered on shorter terms and are more expensive than business microloans.

Figure 2 : Répartition des Institutions de la Microfinance (IMF) par type de microcrédit octroyé

It is also worth noting that the terms and conditions of microloans are very diverse among European countries. The average annual interest rate on business microloans varies from 3% in Poland, Finland and France to 28% in Serbia. There is also a wide spectrum for personal microloans, ranging from 4% in Italy and France to 41% in the UK. This is mainly due to differences

in national legal frameworks, particularly the presence of usury laws (lack thereof, as in the UK) or a regulatory environment that allows for competition, as it is not currently the case in Serbia. Other factors include the business model adopted by the MFI, the level of public support (i.e. high in France), refinancing costs and inflation.

Figure 3: Average terms and conditions of microloans

A comparison of the average loan size also provides a contrasted picture. Assuming that the smaller the loan size (as a percentage of the Gross National Income per capita), the poorer the client, the four countries that reported the lowest ratio and therefore where MFIs are targeting the poorest clients, are Germany (6%), France (11%), Switzerland (12%) and the United Kingdom (16%). Conversely, this average loan ratio is more than 100% in Hungary and Poland. These results are an example of the different target groups that the microfinance sector is serving across Europe, ranging from the financially excluded population underserved by banks to potentially successful micro-enterprises that are financially excluded because of the underdeveloped financial sector.

Nicola BENAGLIO

Policy and Research Officer

European Microfinance Network (EMN)