Since the start of its monitoring in 2013, microcredit has grown at a fairly steady rate in France. Yet, the amounts are still modest given the role microcredit could play in terms of financial inclusion.

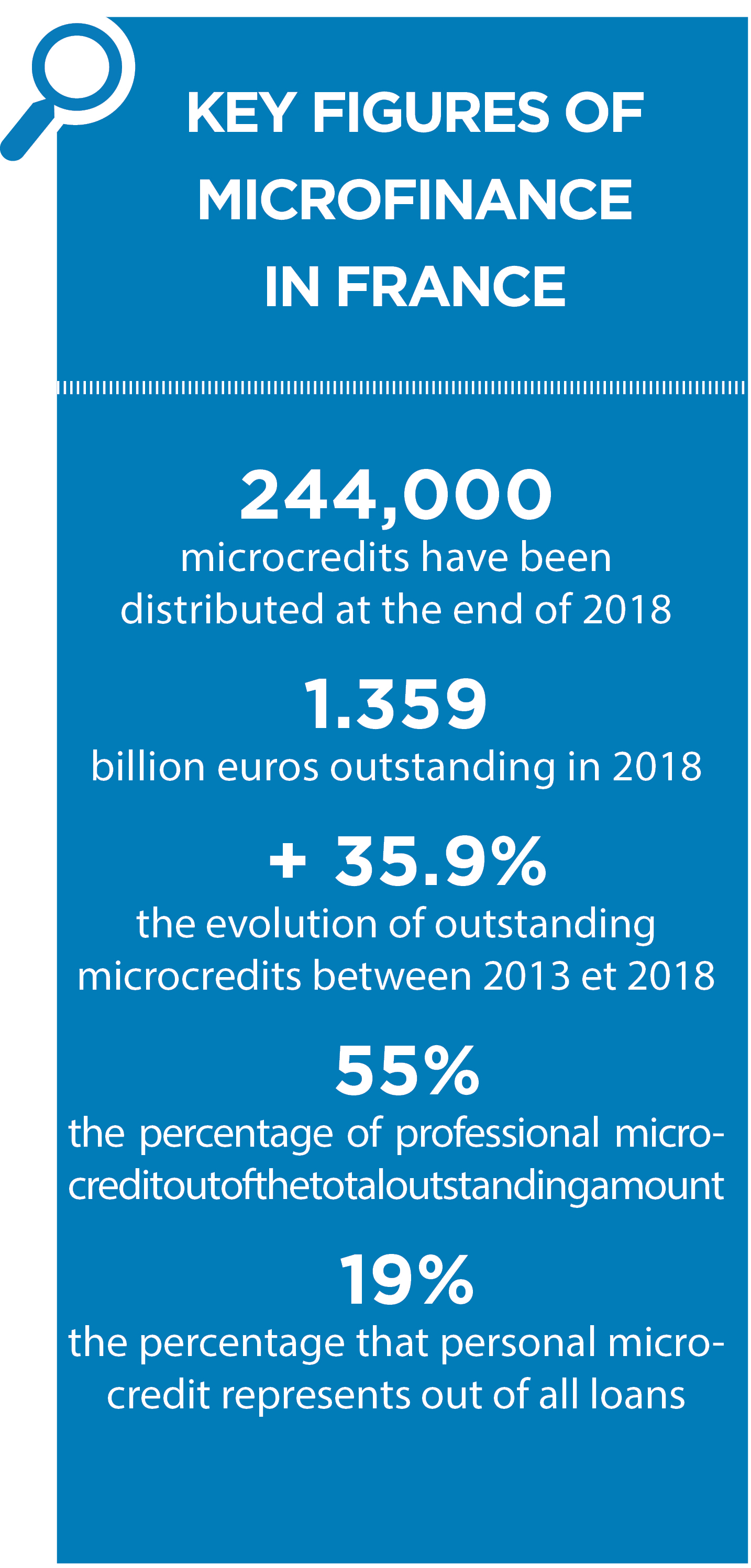

With 244,000 microloans outstanding at the end of 2018, representing an amount of  €1.359 billion, compared with nearly €1 billion in 2013, microcredit continues to grow steadily in France. Most loans are professional in nature (55% of the outstanding amount) or used to finance equity capital (40% of the outstanding amount). Only 5% of the outstanding amount is used to finance personal projects (e.g. the purchase of a vehicle), but the personal microcredit still makes up to 19% of the total number of loans.

€1.359 billion, compared with nearly €1 billion in 2013, microcredit continues to grow steadily in France. Most loans are professional in nature (55% of the outstanding amount) or used to finance equity capital (40% of the outstanding amount). Only 5% of the outstanding amount is used to finance personal projects (e.g. the purchase of a vehicle), but the personal microcredit still makes up to 19% of the total number of loans.

In France, microcredit is supported by the state: it is used to pursue personal and professional projects with the help of specialised social workers and organisations that support business creation. This enables borrowers to access finances that would not otherwise be available to them. In this respect, assisted microcredit constitutes an excellent method for improving banking and financial inclusion. Though it is already promoted by public authorities, the development of microcredit requires raising awareness among potential borrowers.

By making microcredit more visible and more accessible, and by bringing social stakeholders, associations, public institutions and bankers together with microcredit institutions, these types of products can be more effectively marketed. Banque de France and its branches already manage over-indebtedness and basic account rights, but also actively promote microcredit by supporting discussions between stakeholders at the regional and national levels through the Banking Inclusion Observatory, chaired by the Governor. Since 2016, the bank has implemented a new tool: the national strategy for financial, budgetary and economic education.

Communication and financial education, driver of microcredit growth

The aim of this strategy is to provide everyone with practical knowledge and good financial behaviours to help them make more informed choices about repayments, loans, savings and insurance. The objective is to ensure that everyone can make decisions towards financial well-being, that they do not miss economic opportunities, and that they avoid inappropriate choices given their needs and situation and avoid scams.

In this respect, improving French citizens’ awareness of microcredit increases the use of this tool, which is useful both economically and socially, while at the same time reinforcing borrowers’ ability to repay loans, as microcredit represents a binding commitment. The online platform of Budgetary and Financial Education, “Questions about Money” (www.mesquestionsdargent.fr) offers simple, neutral and educational content from national strategic partners, supported by the Banque of France. An entire section is dedicated to microcredit.

In every French department, branches of the Banque de France offer social workers, employees and voluntary associations training sessions on microcredit, as well as on other subjects: prevention of over-indebtedness, payment methods, accounts and banking services, etc.

STÉPHANE TOURTE

HEAD OF RETAIL BANKING &

MARK BEGUERY

DIRECTOR OF FINANCIAL EDUCATION

BANQUE DE FRANCE