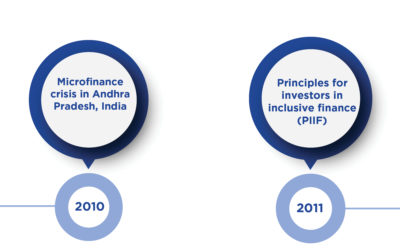

To celebrate the 10 years anniversary of the Microfinance Barometer we look back this year at the trends that have shaped the sector over the last decade.

How did the over-indebtedness crises of the 2010’s improve social impact management practices? New technologies can improve the performance of microfinance, but how can we ensure that they are used responsibly? What lessons can microfinance teach new actors in responsible finance? What is the future of microfinance with the advent of impact investing?

Through case studies, expert analyses and interviews, this edition reflects on the episodes that have had a profound impact on microfinance over the past 10 years to highlight the evolutions of the sector. Expertise in creating tools and indicators to measure social performance, the responsible use of new technologies, the diversification of services (financial and non-financial) to include the most vulnerable populations: there are many lessons to be learned from the changes in microfinance. May they be useful in the growing field of impact investing.

ARTICLES FROM THE BAROMETER

Microfinance and financial inclusion: terminology aside, is there a real difference between the two?

Over the past decade, microfinance has gradually evolved into the broader field of financial inclusion. But are these two terms interchangeable? Renée Chao-Beroff, Director of Pamiga, and Isabelle Guerin, a researcher at the Institute of Research for...

Do private microfinance stakeholders really care about Social Performance?

More than 10 years ago, Nobel Peace Prize Laureate Muhammad Yunus said “I firmly believe that we can create a poverty-free world if we collectively believe in it. In a poverty-free world, the only place you would be able to see poverty is in the poverty...

Reusing the (Social Performance Management) wheel: what can impact investing learn from microfinance

The Microfinance Barometer is celebrating its 10 year anniversary. A look back at the publication’s key themes over the last decade reveals an interesting dynamic. Many of the “hot topics” of the 2010’s, with the exception of digitalisation, could easily...

Social Performance Management is becoming mainstream. An opportunity – or a threat – for the impact investment sector?

As a niche initially confined to distant geographies and populations unattended by the mainstream financial industry, the microfinance sector has since long embraced the issue of social performance. Promising the responsible inclusion of the excluded, and...

Overview of the flagship articles of 10 years of Microfinance Barometer What have been the trends and evolutions of microfinance ?

In a context of renewed economic and social policies aimed at combatting poverty, the emergence of microcredit in the 1980s quickly sparked a lot of interest. Development stakeholders saw in this tool a means of reducing poverty by financially empowering...

Unlocking the potential of microcredit for a more inclusive and dynamic Europe

Thirty years ago, when setting up the Association for the Right to Economic Initiative (ADIE) in France, Maria Nowak introduced in Europe an innovation that had already been successfully developed in Bangladesh by Professor Yunus: microcredit. ADIE’s goal...