Introduction : Counting what really matters

In 1970, in an article published in the New York Times, the Nobel Prize winner in economics, and ultra-liberalist Milton Friedman, expressed his vision of the social utility of business in this way: “Corporate social responsibility is about increasing profits”. Simple. Basic. Until very recently, indeed this vision of the economic world was the dominant discourse. However, a growing number of actors are now strongly fighting to dismantle this idea, and to argue that if companies can be virtuous, they are not necessarily so. They claim that companies should ensure that accounting principles, which are a determining factor for the sustainability of a company, take into account not only economic performance, but also social and environmental performance. According to them, it is therefore necessary to change the way in which the company’s impact is accounted for, integrating a social and environmental dimension into it, and to better measure this impact in order to facilitate the redirection of investments towards responsible companies.

So how can we count what matters? That’s what we talked about at the 11th edition of the World Convergence Forum.

The Triple Accounting

The main rationale behind this triple accounting is as follows: since natural resources (environmental capital) are limited and necessary for production (economic capital) and the purpose of an economy is the increase of the overall social well-being (social capital), the measurement of profitability must necessarily integrate these three values.

The stake of this triple accounting is multiple, as many observers present at the Forum explained. First, the generalization of the measurement of positive externalities of companies makes it easier for them to access financing. Second, impact measurement facilitates the scale-up of companies with a successful economic, social and/or environmental business model. Third, it makes it possible to isolate companies with high negative externalities and to penalize them.

We need to change accounting method because today, it does not take into account any externalities, especially environmental ones

Such a reorientation of the financial system, based on a triple capital valuation, would constitute a real (and necessary) paradigm shift. It would ultimately make it possible to consider the construction of a world of Zero exclusion, Zero carbon, Zero poverty.

The importance of impact measurement

What is impact measurement and how is impact measured? Two complex questions to which the speakers at the Global Convergence Forum tried to answer. The main challenge, behind impact measurement, is obviously to be able to compare different projects in terms of impact. More than a measure of social impact, we now speak of an assessment of social utility, i.e. the causality between the action and the impact. Today, there is no consensus on how to measure impact. That said, there has been a proliferation of standardization tools, including the MESIS (social impact measurement and monitoring) tool created by BNP Paribas, and the Social Business Scorecard tool developed by CERISE, which uses the Sustainable Development Goals as a reference measure. These tools are welcome: they create a basis from which companies (social or traditional) can measure their impact in a meaningful, transparent and comparable way. And it is on this basis that impact investors can more accurately direct their financing.

However, quantifying the impact brings with it risks, in particular the risk of simply doing social washing reporting and creating projects that do not address real needs but instead satisfy the indicators required by investors. Impact measurement must therefore be concrete, objective, verifiable, and respond to the needs and realities on the ground… Above all, it is therefore up to the funder and the bearer of the social project to find a common language on the notion and scope of social impact (employment, territorial cohesion, ecology, solidarity…) as well as on how to measure it. The measurement can be done quantitatively, or qualitatively, in the field.

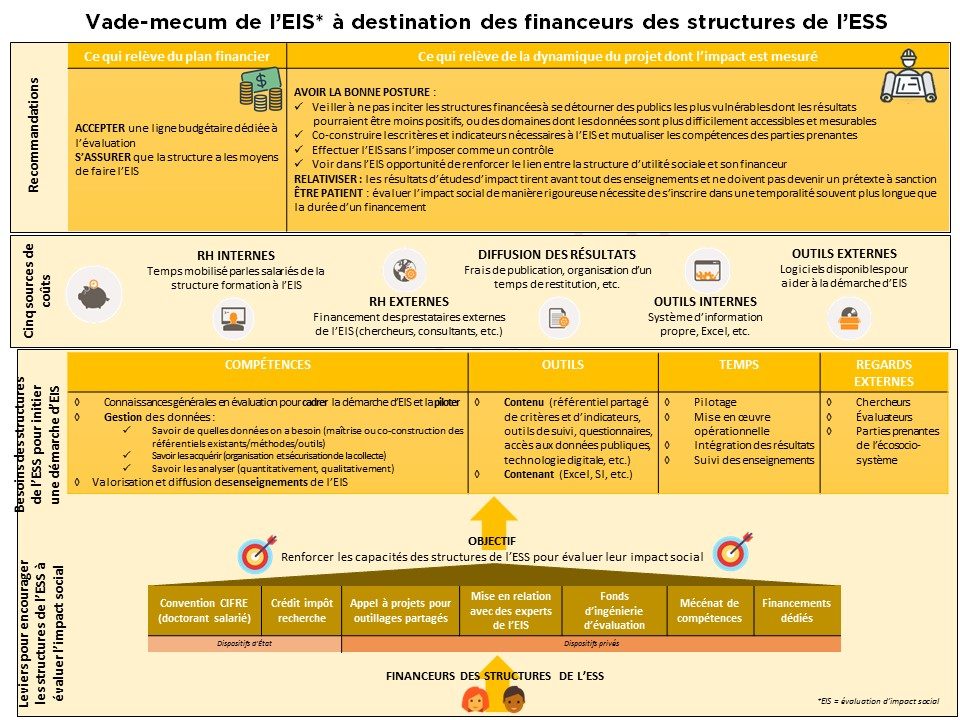

On this occasion, Convergences presented a tool-kit resulting from the work of the participants in the 2nd edition of the Convergences Breakfast on Impact Measurement and geared towards investors of Social and Solidarity Economy sector in order to educate them on the possibilities of supporting structures with high social impact. Indeed, social utility structures have many obstacles to surmount in their impact measurement strategies. Today, the answers are mainly found in the methodological guides, but there are other avenues. However, investors in social utility structures, whether “traditional” banks or solidarity organizations, are increasingly concerned about the social or societal impact of the projects they support. Impact must therefore be measured. These same investors can help to remove many of these barriers and have a role to play in this regard. Detailed in the toolkit resulting from the Convergence Working Groups, the means of support are multiple (financing, contribution of skills, linking up with experts, etc.). While this toolkit does not claim to be exhaustive, it provides an overview of the needs of Social and Solidarity Economy structures to assess their social impact, as well as the existing levers to meet these needs. These various levers differ depending on whether they come from a public or private funder.

Finance has to change its KPIs and metrics to be able to transform itself, it is crazy that CEOs are congratulated for the recovery of their companies when they go through a social plan

Convergences thanks l’Avise and KiMSO for their support in the organisation of the 2nd edition of the Convergences Impact Measurement Breakfast cycle , as well as the structures which helped create it: I&P, (IM)PROVE, Action Contre la Faim, Admical, Aecis, Altersenso, Avise, B&L evolution, BNP Paribas, BSB-education, Carida 2006, CFADS, Company 21, Crédit coopératif, CSF, CO Conseil, Eqosphere, ESSEC, Ethercourt, Fadev, Favart, Fidarec, FINANCE@IMPACT, Finansol, Fondation Agir Contre l’Exclusion – Fondation FACE Fondation Apprentis d’Auteuil, France Active, France Volontaire, GDC, Global Compact France, GNIAC, HAATCH, Kimso, La Nef, Le CEDDRE, Le RAMEAU, LGI Consulting, Lita.co, Love your waste, Make it Real, MezzoCredit, Nantucket Capital, Novethic, NT Trade, Orse, PAMIGA, Passerelles et compétences, Quantis, Sciences Po, Société Générale, SoSciences, StoneSoup, Suez, Total, Vigeo-Eiris, WAX Science, Xange, Wizeimpact, Yunus Center.

THEY WERE PRESENT

- Antonin Amado, RSE DATA News

- Raphaèle Leroy, BNP Paribas

- Cécile Leclair, AVISE

- Emeline Stievenart, KiMSO

- Bernard Horenbeek, La Nef

- Michel Laviale, Orse