Since 2010, the Microfinance Barometer analyses key figures on financial inclusion worldwide, using MIX Market figures on the global microfinance market. Here is a look back at the main trends in the sector.

Focus on institutions and clients

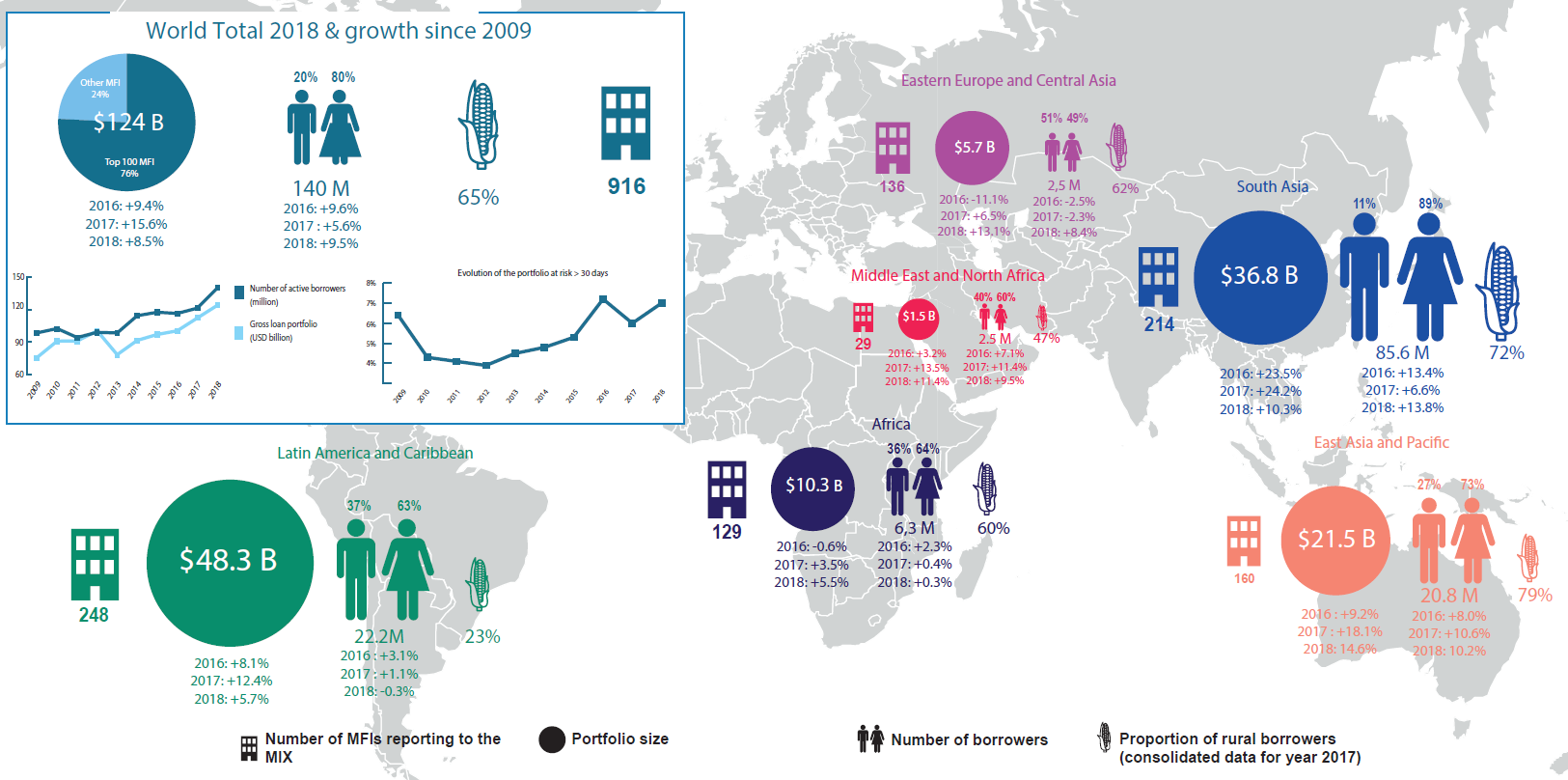

In ten years, microfinance institutions (MFIs) have lent hundreds of billions of dollars, with an average annual growth rate of 11.5% over the past five years. At the same time, the number of borrowers worldwide continued to increase – albeit at a slower pace than in the 2000 to 2010 period – recording an average annual growth rate of 7% since 2012, compared to a rate of nearly 20% in the previous decade.

In 2018, 139.9 million borrowers benefited from the services of MFIs, compared to just 98 million in 2009. Of these 139.9 million borrowers, 80% are women and 65% are rural borrowers, proportions that have remained stable over the past ten years, despite the increase in the number of borrowers. With an estimated credit portfolio of $124.1 billion, MFIs recorded another year of growth in 2018 (+8.5% compared to 2017).

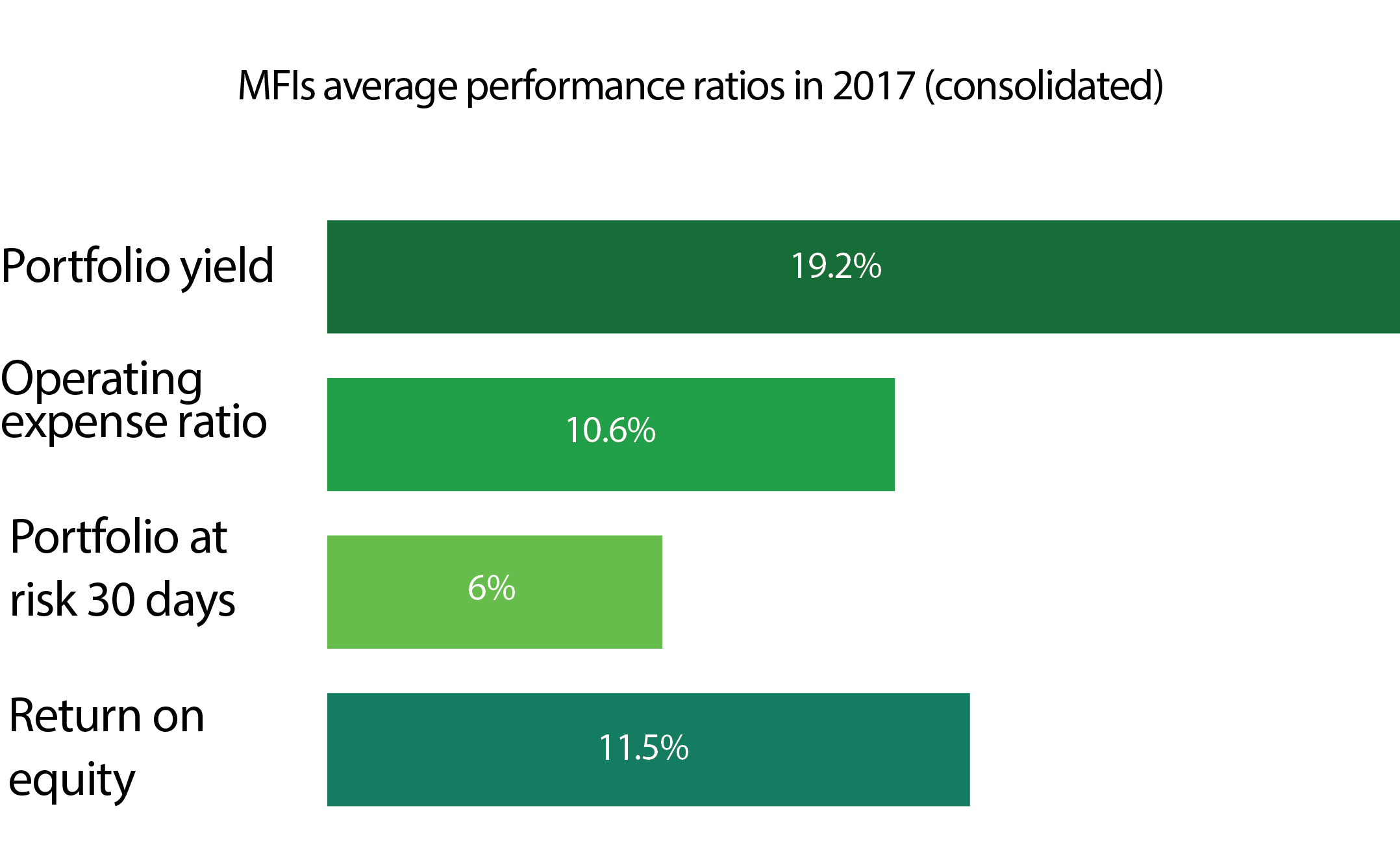

Over the past decade, MFIs have also improved their efficiency. Despite a decade marked by a sharp increase in the cost per borrower, from an average of $68.4 in 2009 to $106.7 in 2018 (+56%), the operating expense ratio decreased by 2.7 points over the period. Between 2009 and 2018, MFIs also recorded an increase in their returns on assets (+1.3 points) and equity (+2.9 points).

Nevertheless, there was a slight deterioration in the quality of the portfolio over the entire period, with the portfolio at risk (PAR) over 30 days having risen from 6.4% in 2009 to 7% in 2018. After a decline in the PAR > 30 days between 2010 and 2012, it rose again and stabilised between 2016 and 2018 at around 7%.

Focus on the regions

South Asia continues to dominate global microfinance: it is the region with the largest amount of borrowers (85.6 million in 2018), with this number growing faster than in other regions (+13.8% between 2017 and 2018). It also has the top three markets in terms of borrowers, India, Bangladesh and Vietnam.

A notable feature of the region, almost all borrowers are in fact female borrowers (89% in 2018). Although it represents almost two-thirds of global borrowers, South Asia is only second in terms of credit portfolio, with an estimated outstanding amount of $36.8 billion in 2018.

In contrast, Latin America and the Caribbean alone account for 44% of the total microfinance sector portfolio, with $48.3 billion in outstanding loans (+5% per year on average since 2012). This region is the second largest in terms of number of borrowers, with 22.2 million customers in 2018, a slightly lower figure (-0.3%) after years of growth. The Latin America and Caribbean region also continues to be characterised by a low penetration rate in rural areas. MFIs in the region are the least rural-oriented, accounting for only 23% of their clients.

In contrast to these leading regions, countries of Eastern Europe and Central Asia as well as those of the MENA region are smaller markets. However, they are growing both in terms of number of customers and credit portfolio. In Eastern Europe and Central Asia, the number of borrowers has increased by more than 30% since 2012, reaching 2.5 million in 2018. The MENA region has the same number of borrowers. MFIs in these two regions also have the lowest proportion of women borrowers, with 49% of female borrowers in Eastern Europe and Central Asia and 60% in the MENA region in 2018. Credit portfolios in these two regions also increased during the period. While the MENA region only experienced weak growth between 2017 and 2018 (+1%), Eastern Europe and Central Asia recorded an increase of 5%, an improvement after the decline in 2015 and 2016.

The total outstanding amount of African MFIs has increased by 56% since 2012, while the number of borrowers increased by 46% over the same period to reach 6.3 million people in 2018. Despite a low quality portfolio (13.6% PAR > 30 days in 2017) and high costs per borrower, the portfolio continues to show a strong yield – 20% – but down 6.6 points. The return on assets also remained positive – 1.9% – but down (-1.4 points).

Finally, with 73% female clients and 79% rural borrowers, MFIs in East Asia and the Pacific continue to grow with a portfolio of $21.5 billion in 2018, up 13.1%. The same year, 20.8 million beneficiaries borrowed from MFIs in this region (+10.2%). Since 2012, the total outstanding amount of MFIs in the region will has increased by an average of 16% per year, accompanied by a continuous but more moderate growth in the number of clients (+6%/year).

BLAINE STEPHENS

CHIEF OPERATING OFFICER &

MOHITA KHEMAR

ASSOCIATE PRODUCT MANAGER

MIX